Description: @RISK is a risk analysis add-in for Microsoft Excel that uses Monte Carlo simulation to show possible outcomes in forecasts and predictions. It allows users to define uncertainty in their spreadsheet models to gain better insights into risks.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

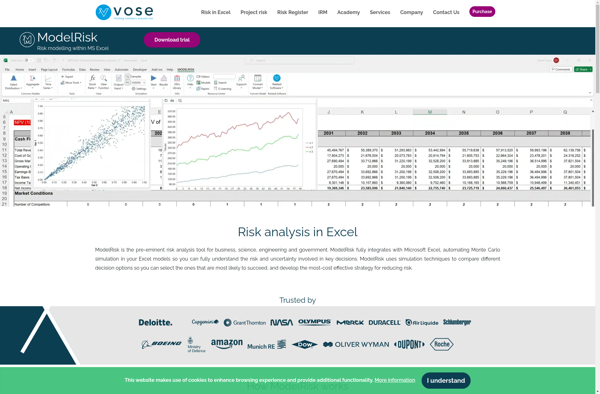

Description: ModelRisk is risk management software used by banks and financial services companies to model and quantify financial risks. It helps build, validate, and audit risk models for market risk, credit risk, and operational risk.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API