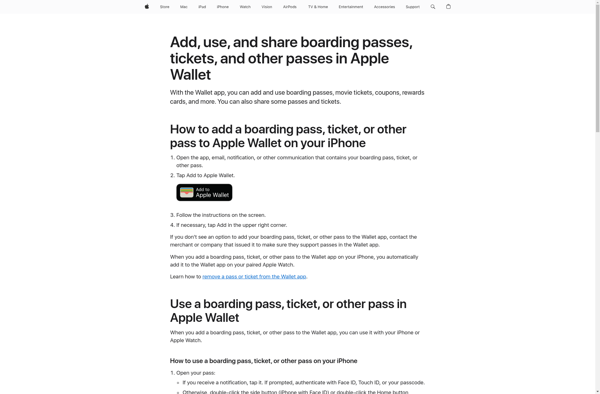

Description: Apple Wallet is a mobile app developed by Apple that allows users to store digital versions of credit and debit cards, boarding passes, event tickets, student ID cards, and more. It provides a convenient way to access these items with an iPhone or Apple Watch.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

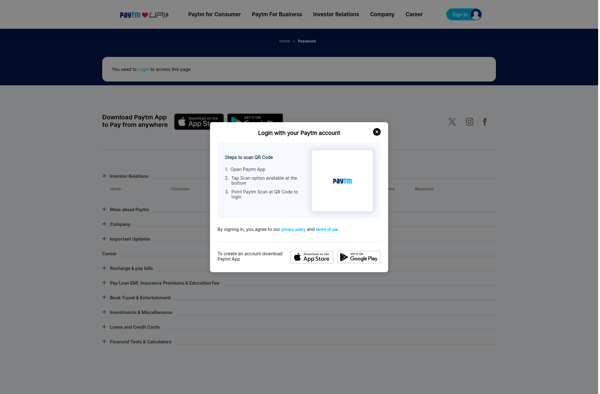

Description: Paytm Wallet is a digital wallet app by Paytm that allows users in India to make cashless payments. It supports payments using credit/debit cards, net banking, Paytm wallet balance and UPI.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API