Description: BackersBox is a crowdfunding software designed to help entrepreneurs and startups raise money for their ideas. It provides customizable campaign pages, built-in payment processing, and tools to manage backers and rewards.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

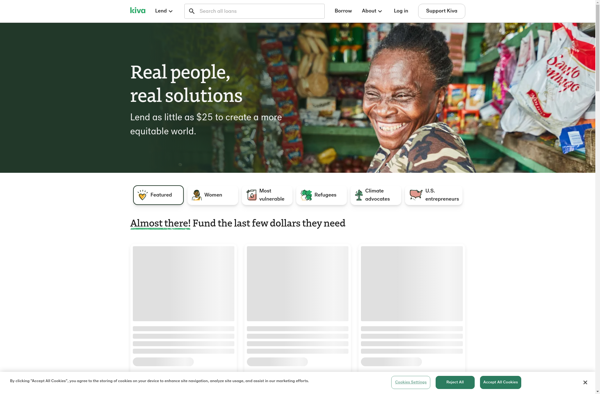

Description: Kiva is a nonprofit organization that allows people to lend money via the Internet to low-income entrepreneurs and students in over 80 countries. Kiva's mission is to connect people through lending to alleviate poverty.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API