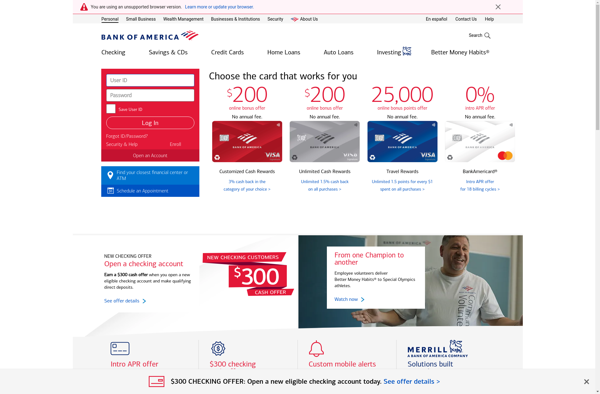

Description: Bank of America is one of the largest banks in the United States, offering services for personal banking, small business, commercial banking, and wealth management. It has nearly 5,000 retail banking centers and over 16,000 ATMs across the country.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: J.P. Morgan Mobile is a mobile banking app that allows J.P. Morgan Chase customers to manage their finances on the go. Key features include checking balances, transferring funds, depositing checks, paying bills, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API