Description: BankExchange is a financial software that allows banks and credit unions to easily switch between core banking platforms. It migrates accounts, transactions, customers, and other data between platforms with minimal downtime.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

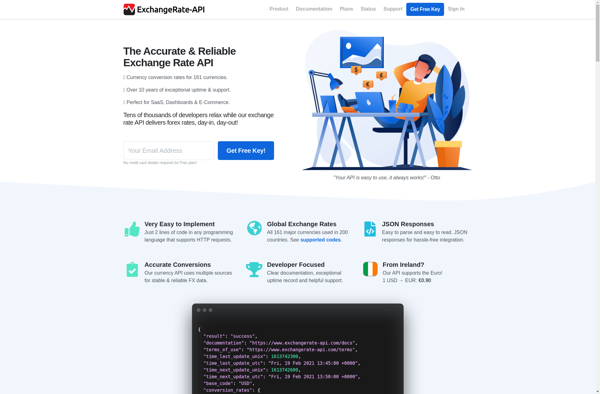

Description: ExchangeRate-API is a currency conversion and exchange rate data API. It provides real-time and historical foreign exchange rates for 168 world currencies. The API is easy to integrate and offers flexible plans for startups and enterprises.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API