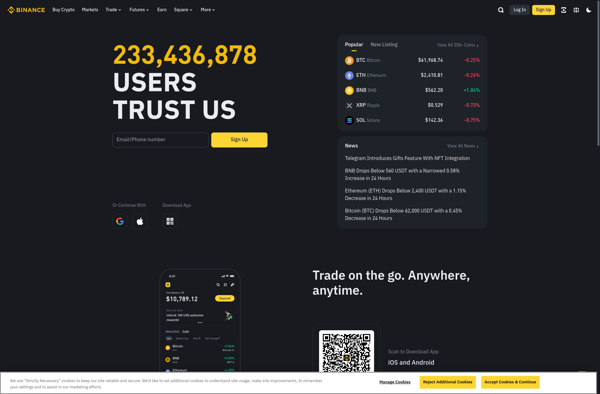

Description: Binance is a cryptocurrency exchange platform that allows users to buy, sell and trade various digital currencies like Bitcoin and Ethereum. It was founded in 2017 and quickly became one of the largest crypto exchanges by trading volume due to its focus on performance, security, and multi-language support.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

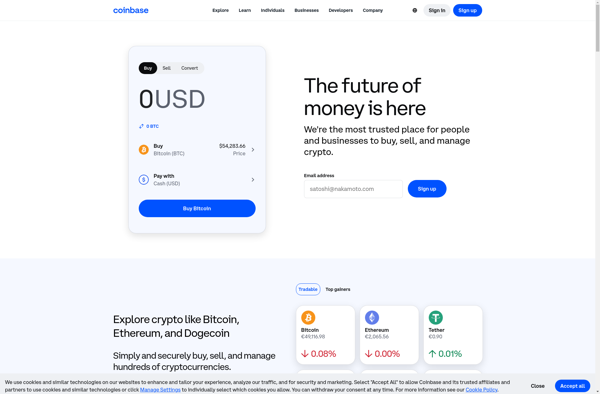

Description: Coinbase is a popular cryptocurrency exchange where users can buy, sell, and store cryptocurrencies like Bitcoin, Ethereum, and more. Its beginner-friendly interface and educational resources make crypto investing accessible.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API