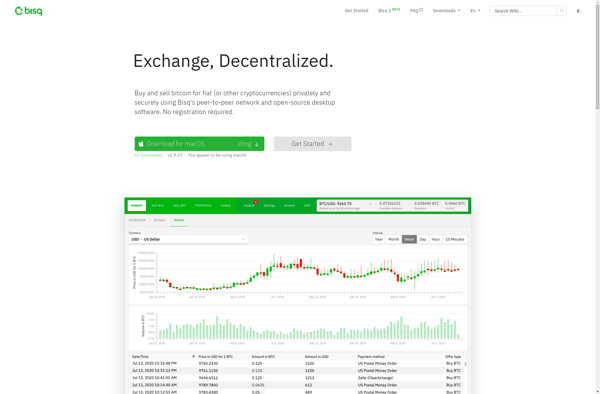

Description: Bisq is an open-source, peer-to-peer application that allows users to buy and sell cryptocurrencies in exchange for national currencies or alternative cryptocurrencies. It provides privacy and security by not requiring any personal information and using end-to-end encryption.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: UnifyPay is a payment processing platform that allows businesses to accept payments online and in-person. It offers features like virtual terminals, invoicing, recurring billing, and multi-currency support.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API