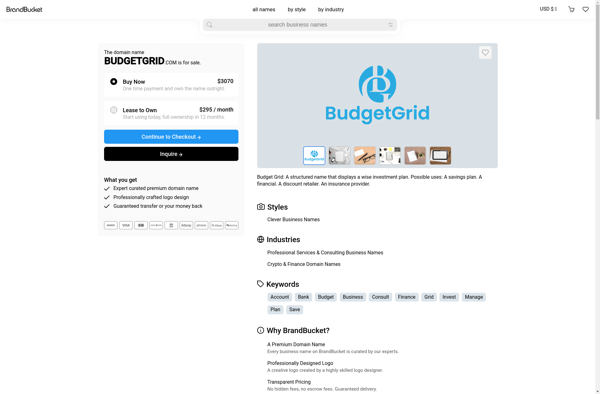

Description: BudgetGrid is a personal budgeting software that helps users track their finances, manage spending, create financial plans, and analyze money habits. Its clean interface and reports make it easy to track budgets.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Bank Balance Check is a personal finance software that allows users to link all their bank accounts in one place to get a consolidated view of account balances and spending. It generates financial reports and provides insights to help users manage their money.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API