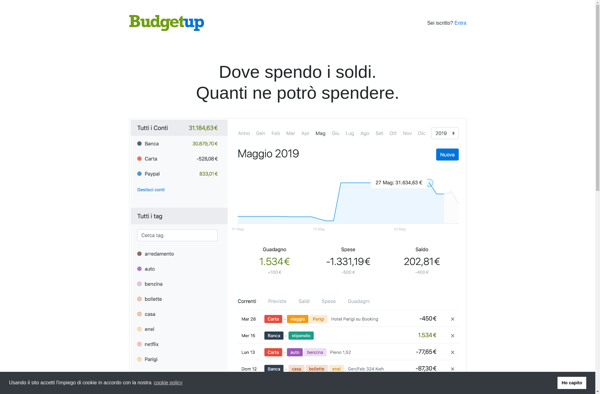

Description: BudgetUp is a personal budgeting and money management software. It allows users to track income, spending, set budgets, organize finances, and analyze financial data through interactive charts and reports. The software syncs with bank accounts for automatic transaction import and easy reporting.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: SmartyPig is an online savings account platform that aims to make saving money simple and rewarding. It offers high interest rates and creates customized goals to help users save for specific things like an emergency fund, vacation, or car.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API