Description: Cashinator is a personal finance app that helps users track expenses, create budgets, and manage money. Its key features include customizable spending categories, automatic transaction imports, budget tracking, graphical reports, and bill reminders.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

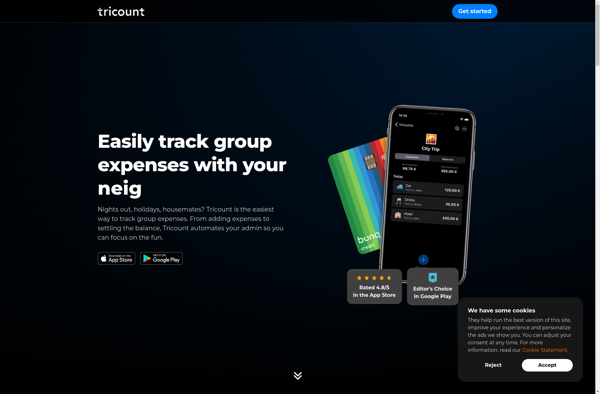

Description: Tricount is a free web and mobile app to track shared expenses and balances within groups. It allows users to easily add expenses, view group balances, and settle up. Tricount simplifies the awkwardness around money with friends.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API