Description: ClickBill is an online billing and invoicing software designed for small and medium-sized businesses. It allows users to create professional invoices, track payments and expenses, manage recurring invoices, and accept payments online.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

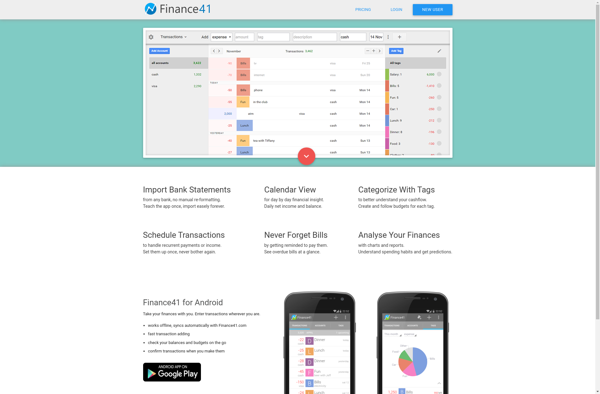

Description: Finance41 is a financial planning and analysis software designed for small and medium businesses. It provides budgeting, forecasting, reporting, and analytics tools to gain visibility into financial data.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API