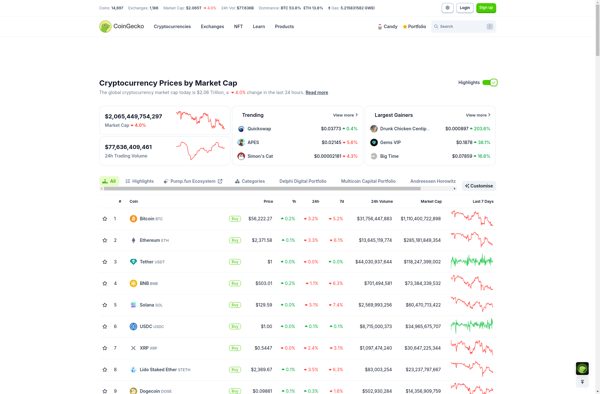

Description: Coingecko is a cryptocurrency market data website that tracks prices, market capitalizations, trading volumes, and more for over 10,000 cryptocurrencies. It offers comprehensive coin data and community growth metrics for decentralized finance and crypto projects.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Coygo Screener is a stock screening and analysis software designed for investors. It allows users to filter stocks based on fundamental and technical criteria to identify trading and investing opportunities.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API