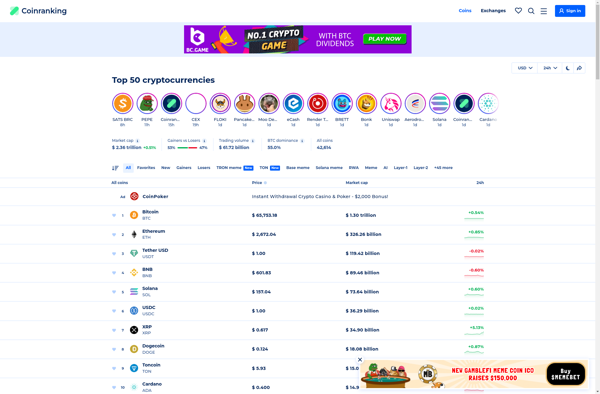

Description: Coinranking.com is a website that provides cryptocurrency data, prices, and market capitalizations. It offers real-time price tracking, coin data, crypto news, and portfolio management tools for over 6000 cryptocurrencies.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Coygo Screener is a stock screening and analysis software designed for investors. It allows users to filter stocks based on fundamental and technical criteria to identify trading and investing opportunities.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API