Description: Copper Banking is an online banking platform focused on small businesses. It offers banking and payment processing tools tailored for entrepreneurs, freelancers, and startups to manage their finances, accept payments, automate accounting, and more from one secure online dashboard.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

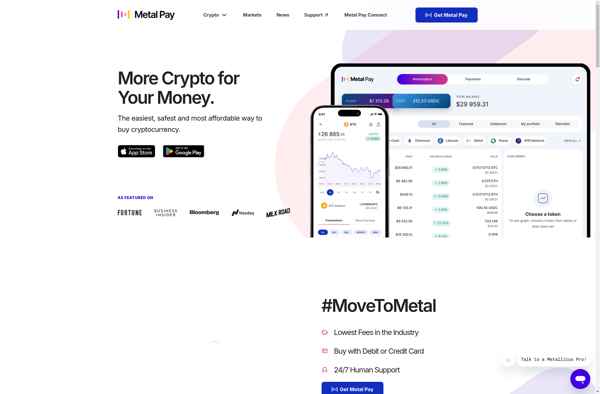

Description: Metal Pay is a peer-to-peer payment app that enables users to send and receive money instantly with no fees. It allows users to store, send, and receive cryptocurrency like bitcoin and ethereum and exchange it for cash.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API