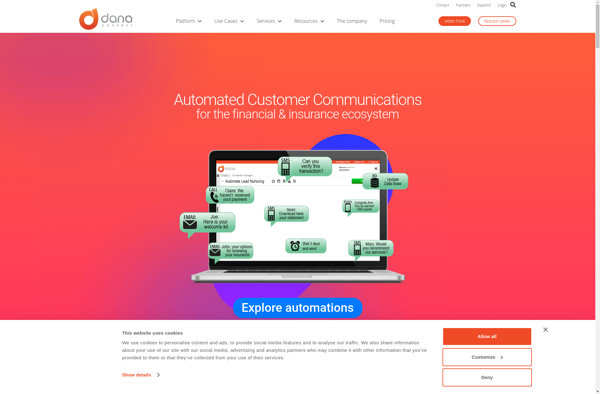

Description: DANAConnect is a software platform that enables seamless integration between digital banking platforms and external financial apps. It allows banks to quickly onboard third-party financial services into their mobile apps to drive engagement.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

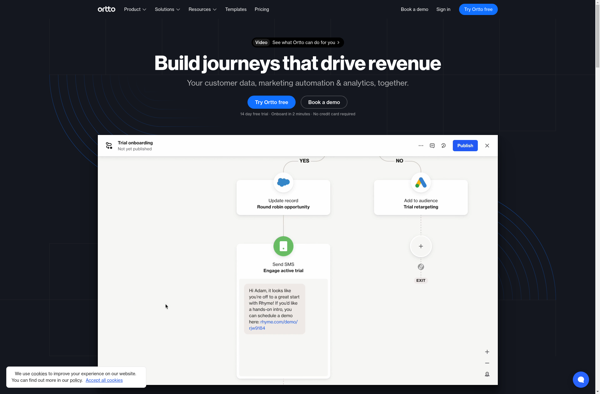

Description: Ortto is a task management and team collaboration tool that helps teams plan projects, manage tasks and deadlines, and work together more effectively. It provides features like task lists, Kanban boards, time tracking, calendars, reminders, commenting, and integrations with other apps.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API