Description: Deriscope is an Excel add-in for financial derivatives analytics and Monte Carlo simulation. It allows creating flexible pricing models and analyzing risks in Excel spreadsheets.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

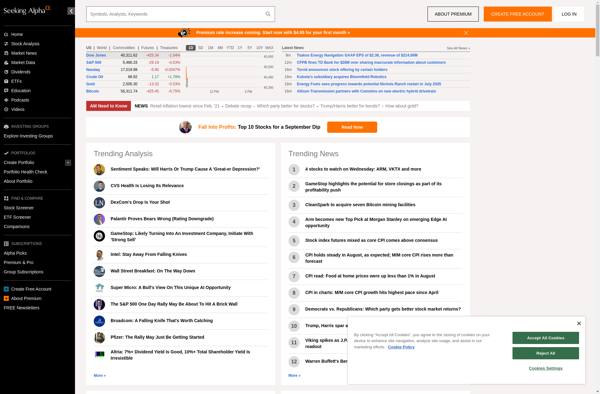

Description: Seeking Alpha is an online crowd-sourced content service for financial markets. It provides news, opinion and analysis for stocks, ETFs and mutual funds from contributors and covers earnings, dividends, and macroeconomic events.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API