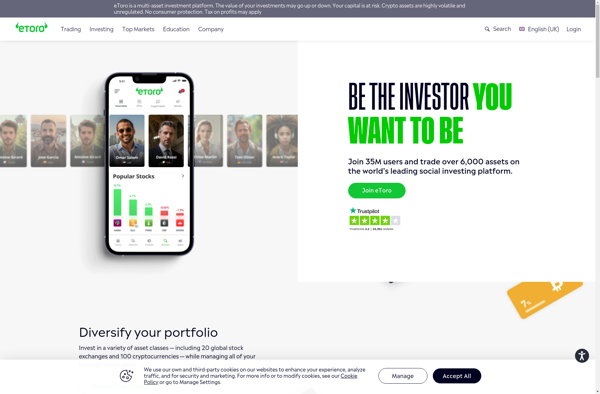

Description: eToro is a social trading platform that allows users to invest in stocks, cryptocurrencies, ETFs, and more by copying successful investors. It has a user-friendly interface and focuses on simplicity, transparency, and community.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: WealthBox.in is a personal finance and wealth management platform that helps users track expenses, create budgets, manage investments, and plan for financial goals. It offers tools to organize finances and get a holistic view of money.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API