Description: Everydollar is a budgeting app created by Dave Ramsey to help users manage their finances, track spending, create budgets, and achieve financial goals. It has a simple interface, is available on mobile and desktop, connects to bank accounts, and has paid and free versions.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

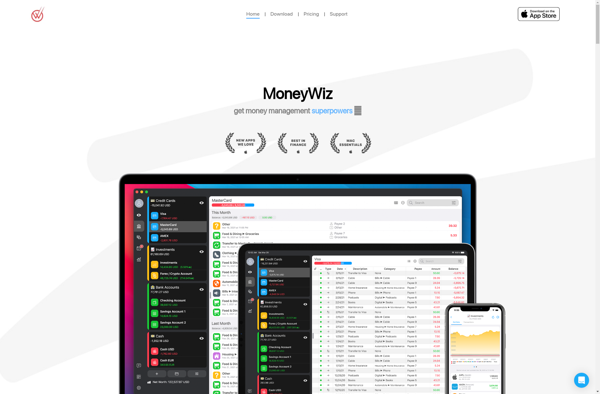

Description: MoneyWiz is a cross-platform personal finance app that helps you track your spending and categorize transactions to create budgets and reports. It syncs across devices, has a clean interface, and provides reminders and alerts.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API