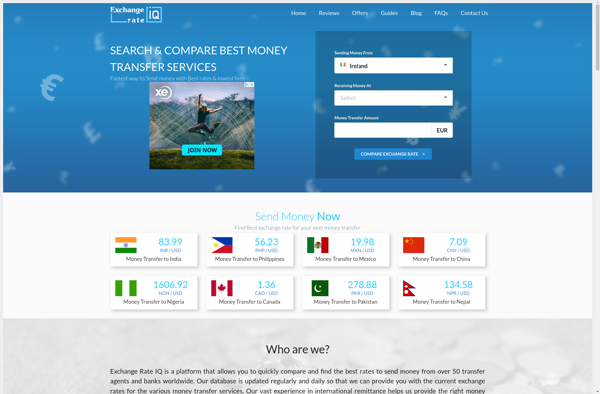

Description: Exchange Rate IQ is a currency data feed and API provider that offers real-time and historical foreign exchange rates for businesses. It covers over 180 currencies and is used by companies for financial reporting, auditing currency exposures, and integrating dynamic currency conversion in applications.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

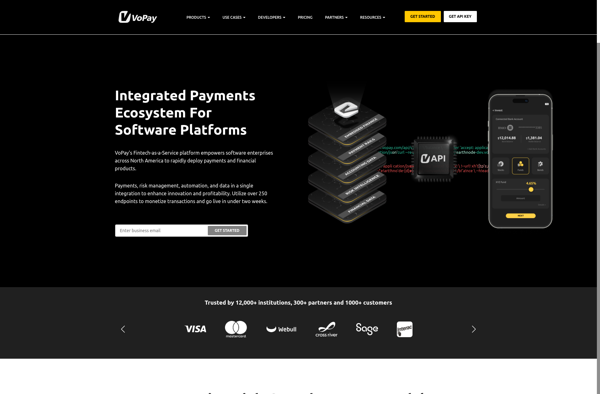

Description: VoPay is a payment processing platform that enables online merchants to accept payments via phone calls. Using VoPay, customers can complete purchases by calling a virtual phone number and entering payment information via their phone keypad. VoPay handles call routing, card capture, payment processing and fraud detection on behalf of merchants.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API