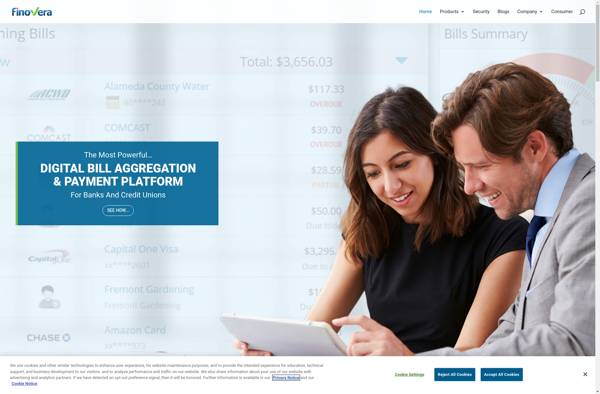

Description: Finovera is an AI-powered financial analytics platform that helps businesses make better financial decisions. It provides real-time insights into cash flow, budgets, forecasts, and more through easy-to-use dashboards and reports.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: ClearCheckbook is a personal finance app that helps users track spending, create budgets, and manage money. It has an easy-to-use interface for entering transactions and features reporting tools, bill reminders, and automatic syncing across devices.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API