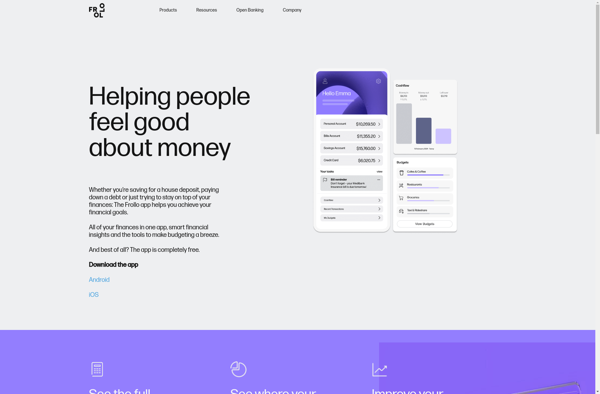

Description: Frollo is a financial management app that aims to help users spend smarter, save more, and learn good financial habits. It uses artificial intelligence and machine learning to analyze spending patterns and provide personalized money advice.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

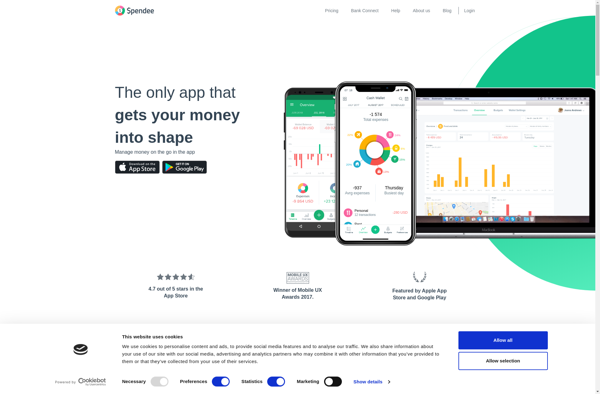

Description: Spendee is a user-friendly budgeting and expense tracking app available on iOS, Android, Mac, Windows and as a web app. It allows users to easily create budgets, categorize expenses, track spending habits over time and stay on top of finances through automatic bank imports, notifications and reporting.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API