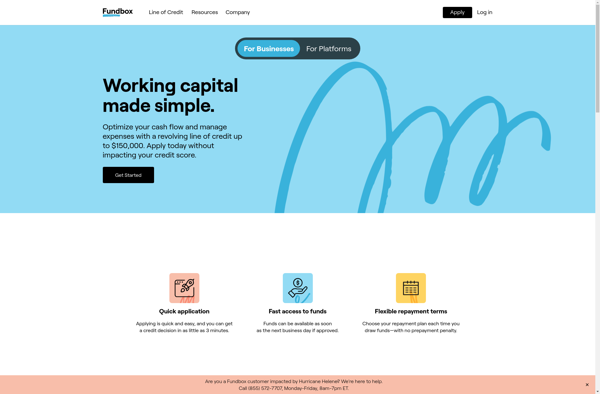

Description: Fundbox is a financial technology company that provides credit and payments automation for small businesses. Their products include lines of credit, invoices, and payments options to help small businesses with cash flow.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: TIO MobilePay is a mobile payment application that allows users to pay bills, send money to friends, and make purchases. It is offered by TIO Networks Corp and integrates with users' bank accounts for easy mobile money management.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API