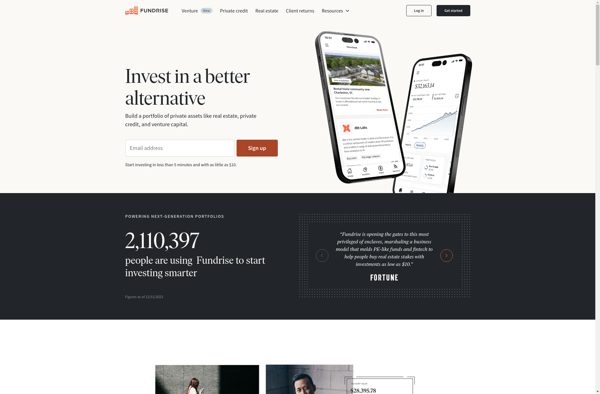

Description: Fundrise is an online investment platform focused on real estate crowdfunding. It allows users to browse and invest in residential and commercial real estate projects across the U.S., offering lower investment minimums and fees than traditional private investment funds.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: AlphaFlow is a fintech lending platform that provides fast and flexible financing for real estate investors and developers. It utilizes advanced algorithms to evaluate risk and provide competitive rates on bridge loans, fix & flip loans, rental loans, and new construction loans within days.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API