Description: justETF is an online platform that allows investors to easily discover, analyze, and invest in Exchange Traded Funds (ETFs). It provides tools to screen, compare, and evaluate ETFs across different categories and asset classes.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

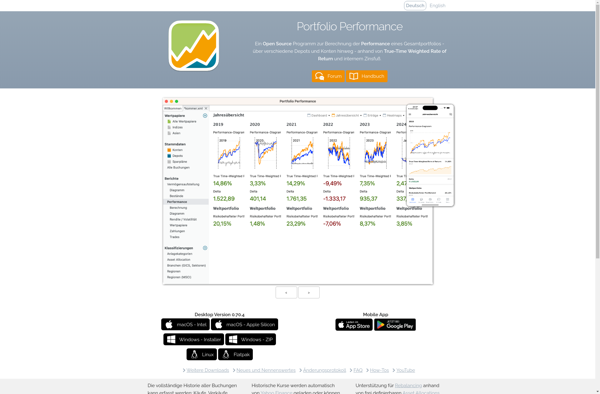

Description: Portfolio Performance is an open source tool for analyzing the performance of investment portfolios. It allows you to track stocks, funds, ETFs, currencies, crypto and other assets to see realized and unrealized gains, asset allocation, transactions, etc. Useful for DIY investors to monitor their portfolios.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API