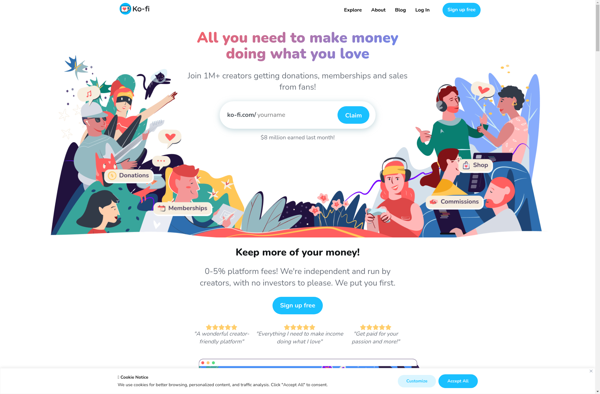

Description: Ko-fi is a crowdfunding membership platform that allows content creators to receive donations and tips from their fans and supporters. It provides a simple way for creators to monetize their content.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: PeachPay is an easy-to-use payment processing application designed for small businesses. It allows entrepreneurs to accept credit card payments in-store, online, or on mobile devices through an intuitive interface and competitive transaction rates.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API