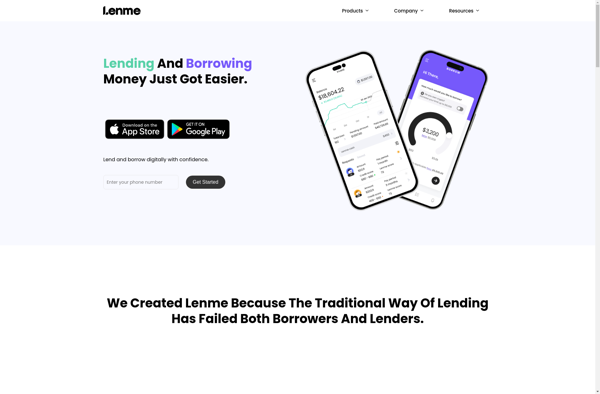

Description: Lenme is an open-source alternative to Microsoft Lens. It is designed for document scanning, whiteboard scanning, and business card scanning on mobile devices. Lenme has powerful OCR capabilities that allow it to recognize text in images and make text searchable.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: SoLo Funds is a peer-to-peer lending platform that allows users to lend and borrow money from each other without the need for a middleman. It aims to provide affordable financial services by cutting out traditional financial institutions.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API