Description: Manilla is a free service that helps you manage all of your bills and subscriptions in one place. It allows you to organize and track bills, get payment reminders, and even automate payments. Manilla collects all of your billing information and statements and makes them easy for you to access and review from any device.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

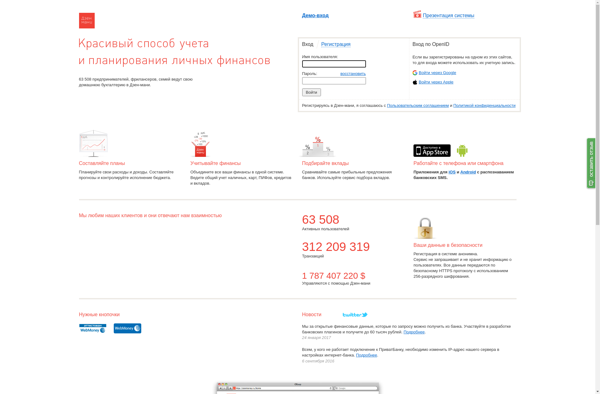

Description: Zenmoney is a personal finance manager and budgeting app for Android and iOS. It allows users to track income and expenses, create budgets, analyze spending habits, manage bank accounts and investments in one place.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API