Description: Minipay is an open-source payment processing software designed for small to medium-sized online businesses. It allows merchants to easily accept payments online through credit cards, PayPal, and other methods without requiring a merchant account.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

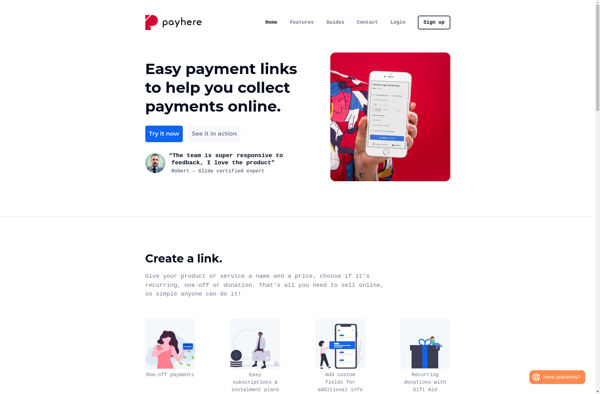

Description: PayHere is a mobile payment processing application that allows small businesses to accept credit card payments anywhere using their smartphones or tablets. It offers a free card reader and has no monthly fees or contracts.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API