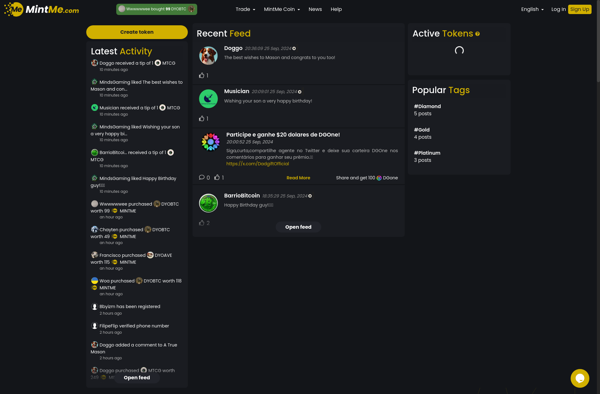

Description: MintMe is a NFT generator that allows users to create their own art and convert it into NFT (non-fungible token). Users can customize the art, backgrounds, filters, and frames, then mint into unique NFTs.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Funded Life is a personal finance and budgeting software that helps users track expenses, create budgets, set financial goals, and make better money decisions through intuitive reports and analysis. It has mobile apps, bank syncing, and community forums for support.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API