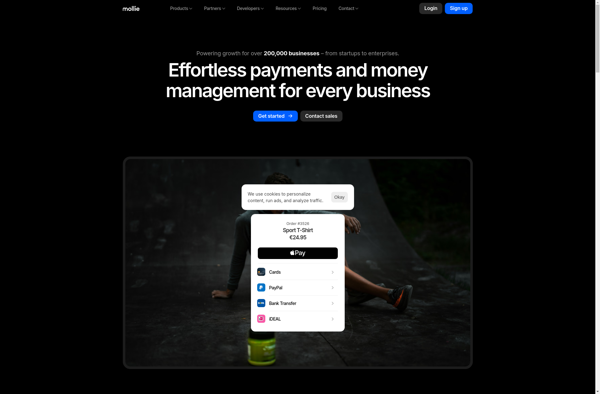

Description: Mollie is an online payment processing platform that allows businesses to accept payments online. It supports popular payment methods like credit cards, PayPal, Apple Pay, and bank transfers. Mollie handles the payment processing so businesses don't have to worry about compliance or managing transactions.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Braintree is a payment processing platform that allows businesses to accept credit card and mobile payments. It provides an SDK to integrate payments into web and mobile apps. Key features include support for various payment methods, fraud protection, global currency and localization capabilities.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API