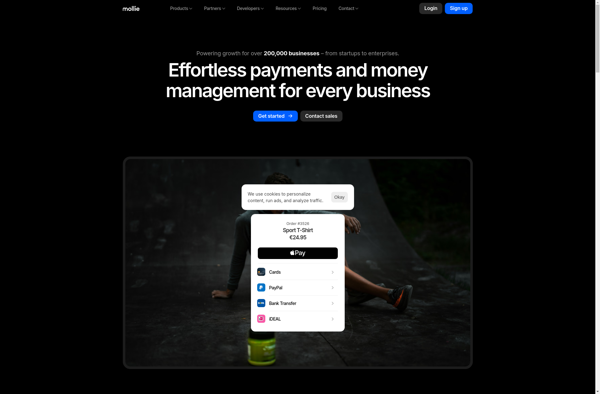

Description: Mollie is an online payment processing platform that allows businesses to accept payments online. It supports popular payment methods like credit cards, PayPal, Apple Pay, and bank transfers. Mollie handles the payment processing so businesses don't have to worry about compliance or managing transactions.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Reepay is an online payment gateway and merchant account provider that allows businesses to accept payments online. It offers integration with major online shopping carts and custom API integration. Key features include credit card processing, recurring billing, Fraud protection, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API