Description: Monarch is a data extraction and web scraping tool that can extract data from websites, PDFs, and other unstructured data sources. It uses visual interfaces to build scrapers without coding.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

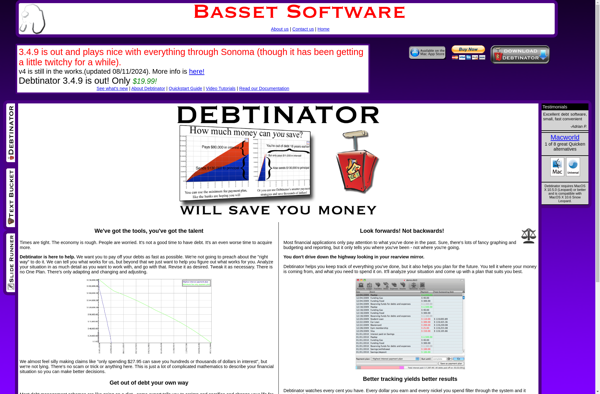

Description: Debtinator is a personal finance app that helps users track, manage, and pay off debt. Its key features include debt tracking, minimum payment projections, customized payment plans, and progress reporting.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API