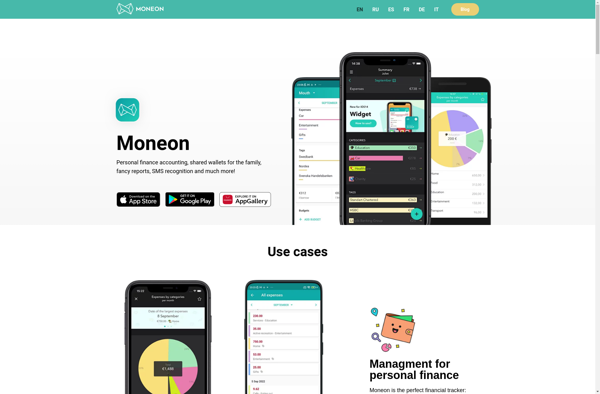

Description: Moneon is an open-source personal finance manager and budgeting software. It allows users to track income, expenses, savings goals, investments, and net worth. Moneon has features for envelope budgeting, reporting, cloud sync, multi-currency support, and more.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

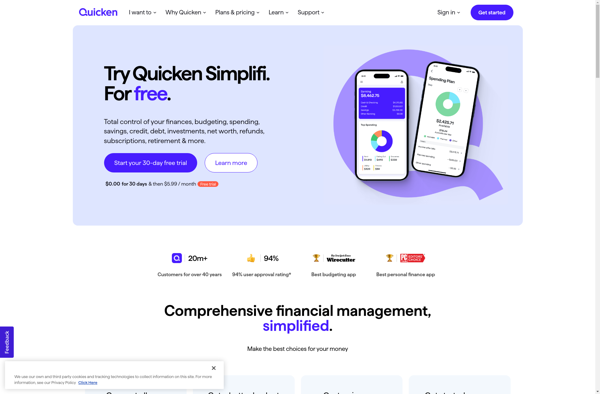

Description: Quicken is a personal finance and money management software. It allows users to track bank accounts, investments, income and spending, create budgets, organize tax information, and more. Quicken aims to help users manage their finances, save money, plan for retirement, and reach financial goals.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API