Description: Moneypex is a personal finance and money management software. It allows users to track income and expenses, create budgets, analyze spending habits, manage investments, and plan for retirement. The software syncs with bank accounts and generates detailed financial reports.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

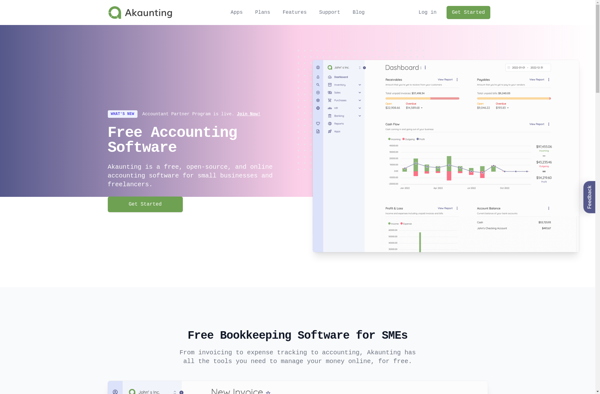

Description: Akaunting is an open-source accounting software designed for small and medium-sized businesses. It offers features for invoicing, expenses, bills, payments, reports, and more. The interface is intuitive and easy to navigate.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API