Description: Moneyspire is a personal finance management software for tracking expenses, creating budgets, and managing money. It offers features like account registers, reports, graphs, forecasting tools, and support for online banking. Moneyspire aims to help users gain control of their finances.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

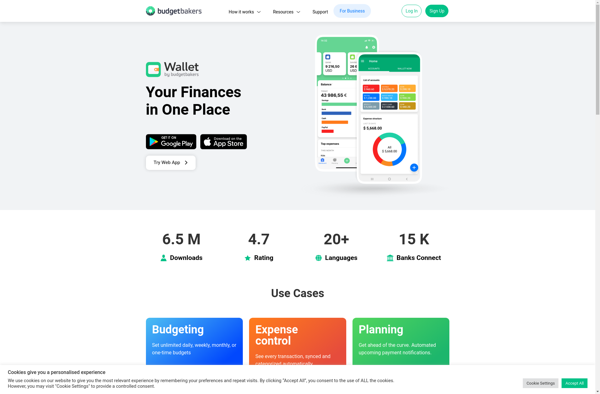

Description: A wallet app is a mobile application that allows you to store, access, and manage your digital assets and cryptocurrencies, such as Bitcoin. It enables secure crypto transactions and payments on-the-go from your smartphone.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API