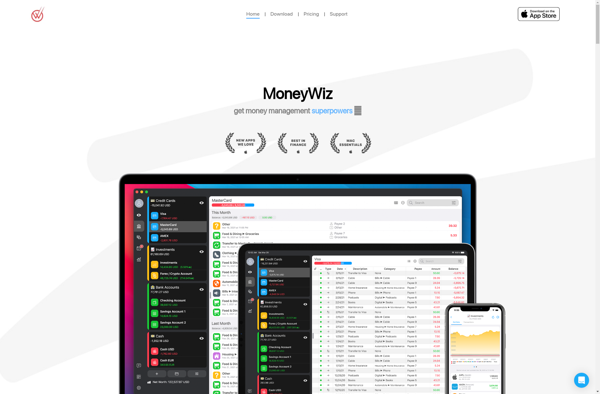

Description: MoneyWiz is a cross-platform personal finance app that helps you track your spending and categorize transactions to create budgets and reports. It syncs across devices, has a clean interface, and provides reminders and alerts.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

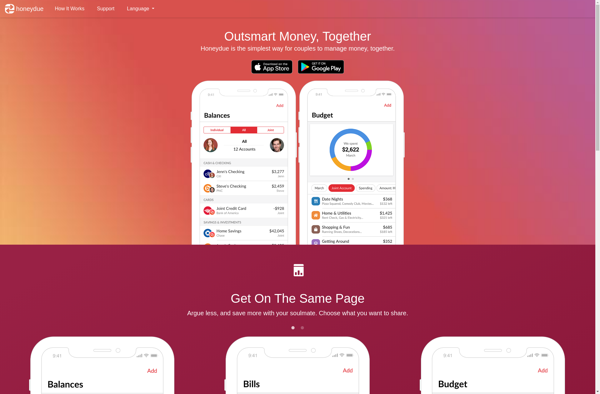

Description: Honeydue is a personal finance app designed specifically for couples to manage shared expenses, set budgets, save towards common goals, and track spending habits together. It helps couples communicate about money in a collaborative way.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API