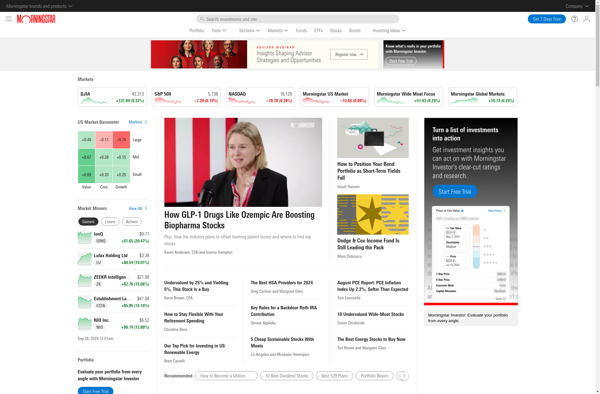

Description: Morningstar is a financial services company that provides investment research and investment management services. Its key offerings include independent investment research, retirement advice, asset allocation guidance, and a wide range of investment products.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: NumHub is a collaborative data science platform that allows data scientists, analysts, and engineers to work together on data projects in the cloud. It provides tools for data preparation, visualization, modeling, deployment, and collaboration.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API