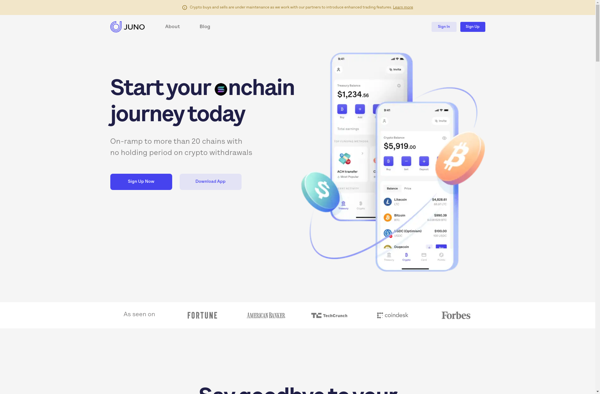

Description: OnJuno is an alternative to traditional banks that provides an integrated banking experience through its mobile app. It offers checking and savings accounts with no monthly fees or minimum balances, automated budgeting tools, access to a large ATM network, and cashback rewards.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Cash App is a mobile payment service developed by Square, Inc. that allows users to transfer money to one another using a mobile phone app. Key features include sending and receiving money instantly with no fees, setting up direct deposit, buying and selling bitcoin within the app, and getting a free debit card that can be used to make purchases or withdraw cash from ATMs.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API