Description: Password Generator 2015 is a free software tool that randomly generates secure passwords for users. It allows customizing password length and character types to create strong, unique passwords for important online accounts.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

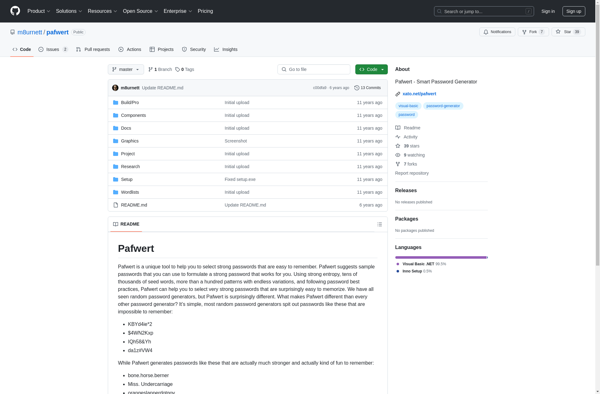

Description: Pafwert is an open-source tool for managing personal finances and budgeting. It provides features like tracking income and expenses, analyzing spending habits, setting budgets, managing bank accounts, investments, and loans.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API