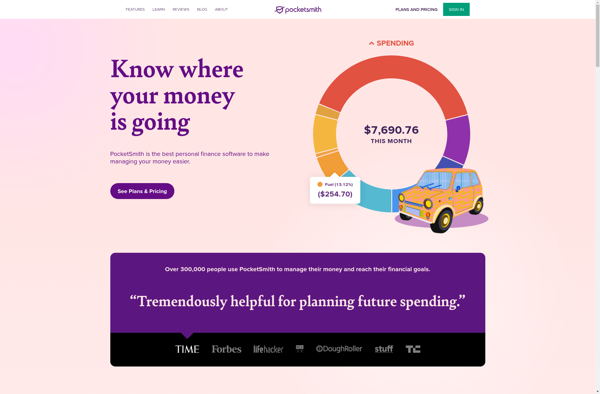

Description: Pocketsmith is a personal finance and budgeting app that helps users track spending, create budgets, analyze finances, and plan for the future. It syncs with bank accounts and credit cards to automatically import and categorize transactions.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

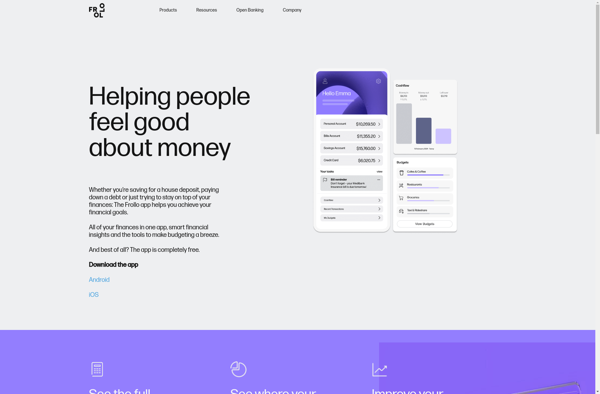

Description: Frollo is a financial management app that aims to help users spend smarter, save more, and learn good financial habits. It uses artificial intelligence and machine learning to analyze spending patterns and provide personalized money advice.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API