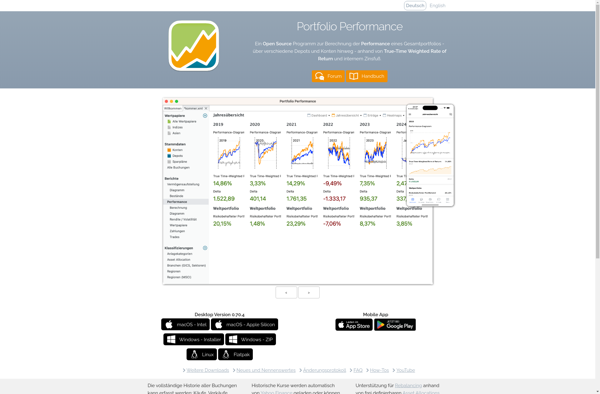

Description: Portfolio Performance is an open source tool for analyzing the performance of investment portfolios. It allows you to track stocks, funds, ETFs, currencies, crypto and other assets to see realized and unrealized gains, asset allocation, transactions, etc. Useful for DIY investors to monitor their portfolios.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: JStock is an open-source stock market monitoring and charting software for Windows, Linux and Mac. It allows users to track stocks, futures, indices, currencies as well as portfolio values. Key features include customizable watchlists, indicators, alerts, portfolio management, news feeds and global market data coverage.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API