Description: Prism Money is a free, open-source personal finance manager. It helps users track expenses, create budgets, analyze spending habits, and manage investments. Prism offers an intuitive interface, robust reporting tools, and support for bank connectivity and encryption.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

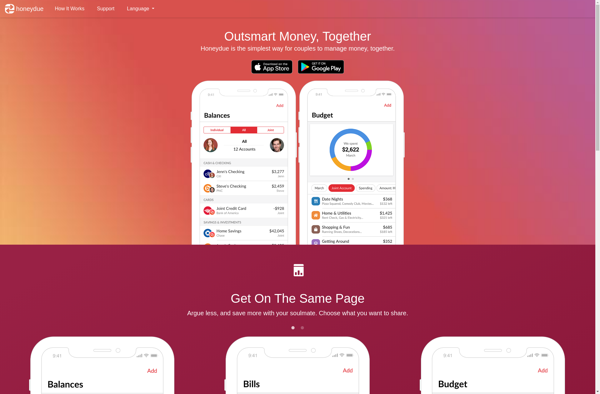

Description: Honeydue is a personal finance app designed specifically for couples to manage shared expenses, set budgets, save towards common goals, and track spending habits together. It helps couples communicate about money in a collaborative way.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API