Description: Quaderno is a cloud accounting software designed for freelancers, consultants, and agencies. It provides tools for time tracking, creating estimates and invoices, CRM, expense tracking, and reporting. Quaderno integrates with popular platforms to streamline workflows.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

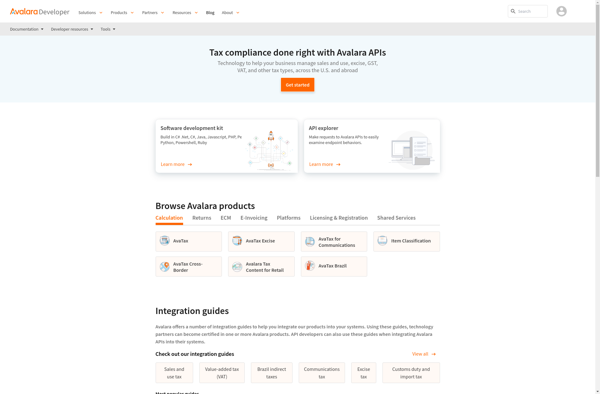

Description: Avalara is a cloud-based tax compliance software that automates the process of calculating, filing, and remitting transactional taxes. It integrates with major ecommerce platforms and ERPs to calculate sales tax, VAT, excise tax, and other transactional taxes in real-time.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API