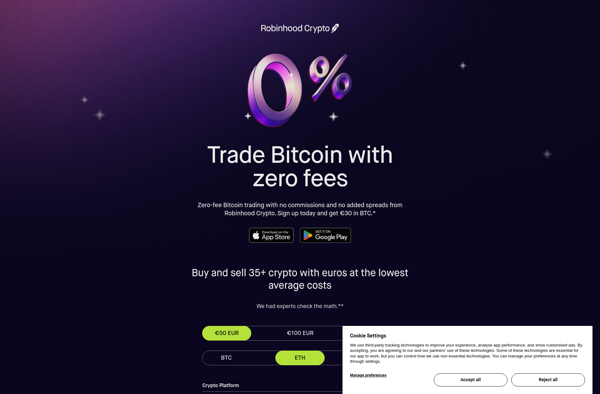

Description: Robinhood is a popular free stock trading app that allows users to buy and sell stocks, ETFs, options and cryptocurrencies with no commissions or fees. It has an easy-to-use mobile interface aimed at novice investors.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: investFeed is a social networking platform for investors and traders to share investment ideas, market analyses, and trading strategies. It allows users to follow other investors, post status updates, participate in discussions, and access financial data.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API