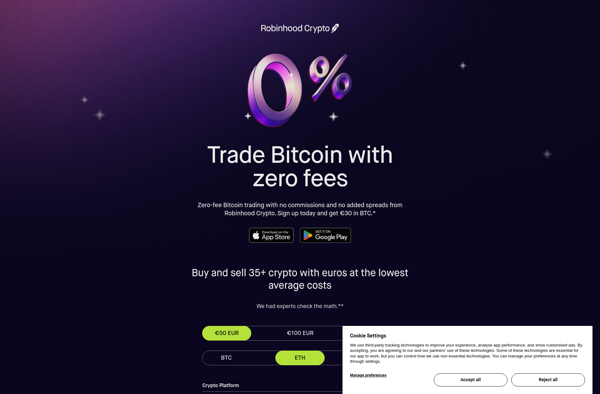

Description: Robinhood is a popular free stock trading app that allows users to buy and sell stocks, ETFs, options and cryptocurrencies with no commissions or fees. It has an easy-to-use mobile interface aimed at novice investors.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: ShareAlpha is a financial data platform that provides stock analysis and screening tools for investors. It offers features like comparative valuation, financial modeling, investor checklists, and customized stock screens to help make better investment decisions.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API