Description: ShareAlpha is a financial data platform that provides stock analysis and screening tools for investors. It offers features like comparative valuation, financial modeling, investor checklists, and customized stock screens to help make better investment decisions.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

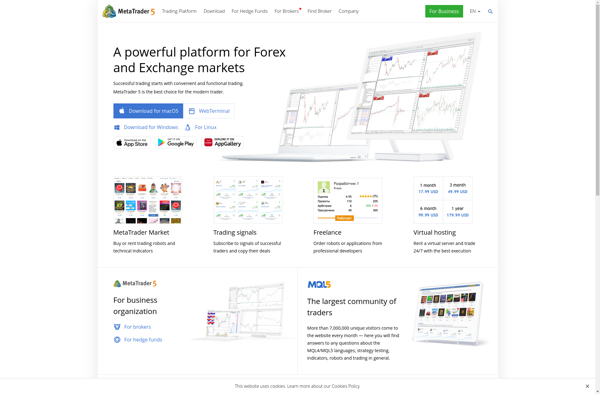

Description: MetaTrader is a popular trading platform used for online trading in the forex, CFDs, futures, and stock markets. It offers advanced charting tools, backtesting capabilities, algorithmic trading, Virtual Private Servers (VPS), and Expert Advisors (EAs).

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API