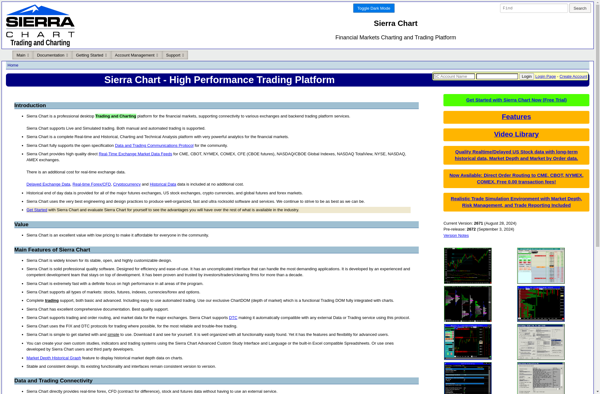

Description: Sierra Chart is a professional charting and trading platform for financial market data. It supports advanced analytics and automated trading strategies with its extensive functionality and highly customizable features.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: FinSharing is a personal finance management software that allows users to track their income, expenses, investments, and budgets. It has features for reporting, analytics, goal setting, and collaboration.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API