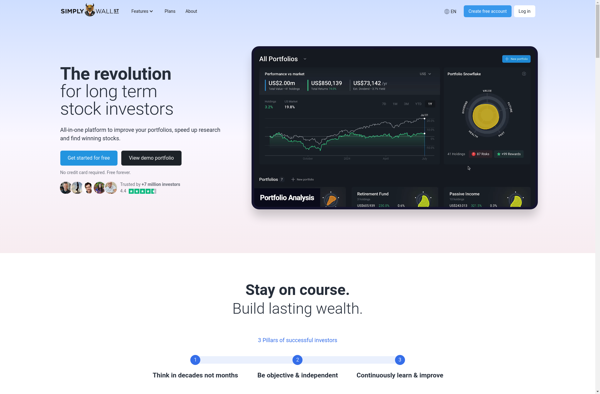

Description: Simply Wall St is a financial data and software company that provides web-based stock analysis tools for investors. Its key features include automated financial modeling, easy-to-understand visualizations, and proprietary algorithms that analyze and compare stocks.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Wallmine is a financial data and analytics platform for stocks, ETFs, mutual funds, currencies, and cryptocurrencies. It provides detailed financial information, news, charts, valuation models, price targets, forecasts, insider trades, SEC filings, and more.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API