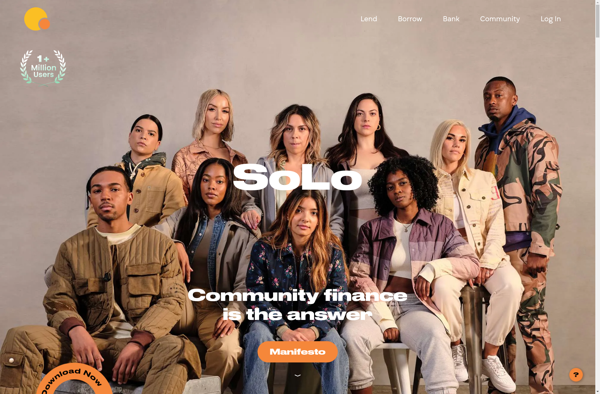

Description: SoLo Funds is a peer-to-peer lending platform that allows users to lend and borrow money from each other without the need for a middleman. It aims to provide affordable financial services by cutting out traditional financial institutions.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

Description: Payday Advance is a type of small, short-term loan that is intended to cover unexpected expenses until the borrower's next paycheck. Payday loans typically have high interest rates and fees.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API