Description: The Warren Group Loan Originator Module is a loan origination software designed for mortgage brokers and bankers to manage the loan application process. It includes tools for taking loan applications, processing and submitting them to lenders, tracking loan status, and managing pipeline and contacts.

Type: Open Source Test Automation Framework

Founded: 2011

Primary Use: Mobile app testing automation

Supported Platforms: iOS, Android, Windows

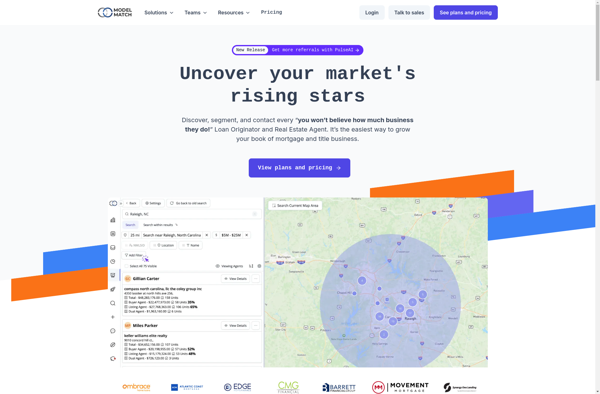

Description: Model Match is an open-source machine learning model management platform that helps data scientists organize, track, version, and monitor their models in production. It provides a central registry for models and enables governance through lifecycle management, reproducibility, and operational visibility.

Type: Cloud-based Test Automation Platform

Founded: 2015

Primary Use: Web, mobile, and API testing

Supported Platforms: Web, iOS, Android, API